What Is Motley Fool’s Stock Advisor?

Launched in 2002, Motley Fool: Stock Advisor is part of Motley Fool’s premium Stock Picking Services, and it was the first product they ever released. As Motley Fool’s flagship product, Stock Advisor has some of the best features across all their other services: As soon as you sign up with Stock Advisor you gain access to a library of 171 stocks plus 25 foundational stocks; must-haves to start building a solid portfolio. Subscribers also receive 12 expert stock reports and detailed recommendations each month, with a bonus video summarizing the thought process behind each pick.

As with most products offered by The Motley Fool, the Stock Advisor service uses a subscription-based model. The yearly plan is only $89 for new users and includes a free trial with a 30-day money-back guarantee. Regular users can sign up for a subscription for $39 per month or $199 per year.

For the past 20 years, Motley Fools’s Stock Advisor has consistently beaten the S&P 500 index, averaging 374% returns vs. 122% from the index; but it isn’t the only Motley Fool product to accomplish this. Motley Fool’s Rule Breakers also has an excellent record compared to the S&P 500 index (182% vs. 99% returns) and focuses on long-term growth. These two are intrinsically different, and each targets different types of investors: in this quick summary, I go over their main differences and which one is best suited for you.

Without further ado, here’s my Motley Fool Stock Advisor review.

Pros & Cons

Pros

- Access to a library of 171 expertly-picked stocks

- Two additional stock recommendations every month

- 374% returns since inception (as of May 2022)

- Access to 25 foundational stocks

- 10 Monthly ‘Best Buys Now’ recommendations

- Video summary of monthly picks and nine bonus reports

Cons

- Your investments may be locked long-term

- Investing in stocks is inherently risky

Features & Benefits Of Stock Advisor

1) Access To A Library Of Expertly-Picked Stocks

As soon as you sign up for Motley Fool’s Stock Advisor, you will gain access to 171 expertly-picked stocks with a track record of very high returns. Two new stocks are added to this list every month, and you can expect an average rate of return of at least 100%. Keep in mind Motley Fool’s philosophy: build a diverse portfolio and hold it for at least five years. By holding your assets for a long period, you are almost guaranteed to ride out the fluctuations in the market, and the potential of the hand-picked stocks will shine through.

2) Build A Diverse Portfolio

Stock Advisor, and Motley Fool in general, encourages investors to build a diversified portfolio. They estimate that with 25 stocks and a long-term plan in mind, investors can start their road towards financial freedom. To achieve this, they recommend a total of 12 stocks each month. 2 of those stocks come from emerging, or promising companies and are heavily screened for maximum long-term wealth generation. They also recommend 10 Best Buy Now stocks – these are stocks that are very likely to go up in the short-to-mid term, and they’re chosen from a pool of 300 promising stocks; you can be sure you’re getting the best of the best from these.

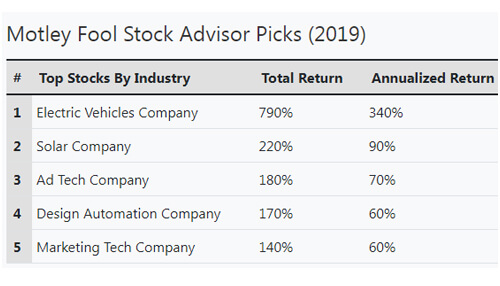

In the next table, I break down the top Stock Advison performers in 2019 – based on industry.

Motley Fool’s Stock Advisor service values diversification very highly, and its approach to investing is slightly different than Motley Fool’s Rule Breakers, which has a narrow focus on growth-oriented stocks.

3) High-Returns – The Best Performing Motley Fool Service

All in all, The Motley Fool has very good services, and it’s not uncommon for it to rank well against the best indices like the S&P 500. For example, Motley Fool’s Rule Breakers has beaten the market for the past 18 years – almost doubling the S&P 500’s return in that same timeframe: 182% for Rule Breakers and 99% for the S&P 500.

But Motley Fool’s Stock Advisor takes it to the next level. Since its inception back in 2001, it has beaten the S&P 500 index by more than 200%. The returns of Stock Advisor since its inception 20 years ago are a staggering 374%, compared to S&P 500’s 122%.

All in all, both Rule Breakers and Stock Advisor are good options, with Stock Advisor taking the lead. But Rule Breakers was always meant for the long-term, and with its strong focus on growth, it’s possible it can overtake Stock Advisor’s record over the long term (we go over how that can happen and their main differences here).

4) Optional – Sign Up For Other Rule Breaker Services

Motley Fool offers three categories of premium services: Stock Picking Services, Real Money Portfolio Services, and Specialty Services. If you’re unsure which premium service is best suited for you, I recommend checking this Motley Fool services guide, where I go over the most cost-effective services and which one is better for you.

As for the Stock Advisor service, it belongs to the Stock Picking Services. Some other services in this category include:

1. Rule Breakers: Future of Entertainment, which explores the most likely winners in the entertainment industry.

2. Rule Breakers: Biotech Breakthroughs, which closely tracks breakthroughs in the Biotech sector.

3. Rule Breakers: Trend-Spotter, which tracks emerging companies and catches possible growth trends.

4. Rule Breakers: Augmented Reality and Beyond, which focuses on technological breakthroughs in virtual reality.

Keep in mind that these products are separate from a Stock advisor – to sign up with some of these, you will have to purchase a subscription. Fees for all these services start at $1,999/year. If you’re interested in more than one, it might be worth considering purchasing a bundle instead – these include several services and come at a discount.

5) 9+ Bonus Reports, Video Snippets, & Educational Resources

On top of the monthly buy, sell, and hold recommendations, Motley Fool: Stock Advisor sends nine additional reports on the state of the stock market, long-term prospects, and more broad market recommendations. Subscribers also receive summary videos – these are around 30 to 60 minutes long and offer insights from the experts. If you want to learn more about what goes on behind the scene of each stock pick, these videos will be very helpful.

If you’re a beginner, Motley Fool offers many educational resources, chief among them their How to Invest in Stocks: A Beginner’s Guide for Getting Started.

Stock Advisor Fees

- Monthly Subscription: $39/month

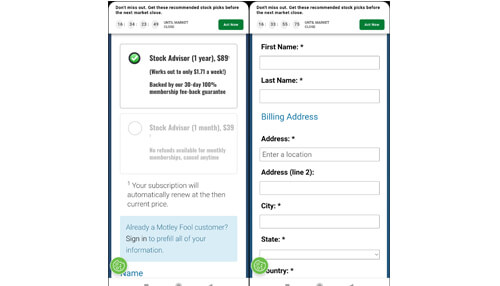

- Yearly Subscription: $89/year

The regular price for yearly subscriptions is $199/year. For new users, the first year is just $89, and it comes with a 30-day free trial – after that period, you can cancel, if you’re not satisfied with the service, and get your money back – no questions asked.

Sign-Up Process

Anyone can register and create a Motley Fool account, but the company mainly focuses on US citizens. There are no special requirements to create an account; all you need is your name, a valid address, and banking information to purchase a subscription. Remember that if you pick the yearly plan, you have a 30-day free trial, after which you can cancel, if you’re not satisfied with the product, and get your money back .

To create an account, visit Motley Fool’s Stock Advisor Page and click the Try Now button.

Scroll down and click on Stock Advisor and fill in your information. The process is very quick and won’t take more than 2 minutes.

Trustpilot Reviews

Rule Breakers has decent reviews from its users, and it holds an average rating of 3.6 on Trustpilot. Here’s what some of those users have to say about Rule Breakers:

1. “I’ve been a Motley Fool Subscriber for about six years now. I have enjoyed their advice, and I like their 5-year outlook.” – John T.

2. “Great information and stock review. To be clear, every stock isn’t a perfect choice immediately, but their advice is spot on.” – Lisa L.

3. “Motley Fool has dramatically increased my rollover IRA. I took its advice and selected 20-24 stocks from the Stock Advisor recommendations.” – Ronald K.

4. “I will not watch long videos and transcripts for advice. When you do this, it feels like a cheap shortcut for compiling data and advice, which is what I pay for.” – Kyle W.

If you are not fully convinced if this particular Motley Fool service is for you after reading these reviews and would like to compare it to other services, here’s our side-by-side comparison between Motley Fool’s two largest services: Motley Fool Stock Advisor vs. Motley Fool: Rule Breakers – Which is better for me?.

Final Thoughts

Stock Advisor is a great option for investors looking to get into the stock market. Its recommendations and reports are easily understandable by everybody, no matter their background, and its monthly picks are always spot on. Experienced investors will find their summary videos – detailing the full stock-picking process – very insightful and their stock library very complete. If you’re a numbers kind of person, you will be glad to know that it has beaten the S&P 500 index consistently for the past 20 years – and you can be sure it doesn’t plan on stopping any time soon.