Why should you reconcile accounts?

Account reconciliation is crucial as it helps detect mistakes, fraud, or discrepancies in the accounting books. It helps the company’s financial health. It is a good business practice to help a business succeed.

What is the importance of account reconciliation?

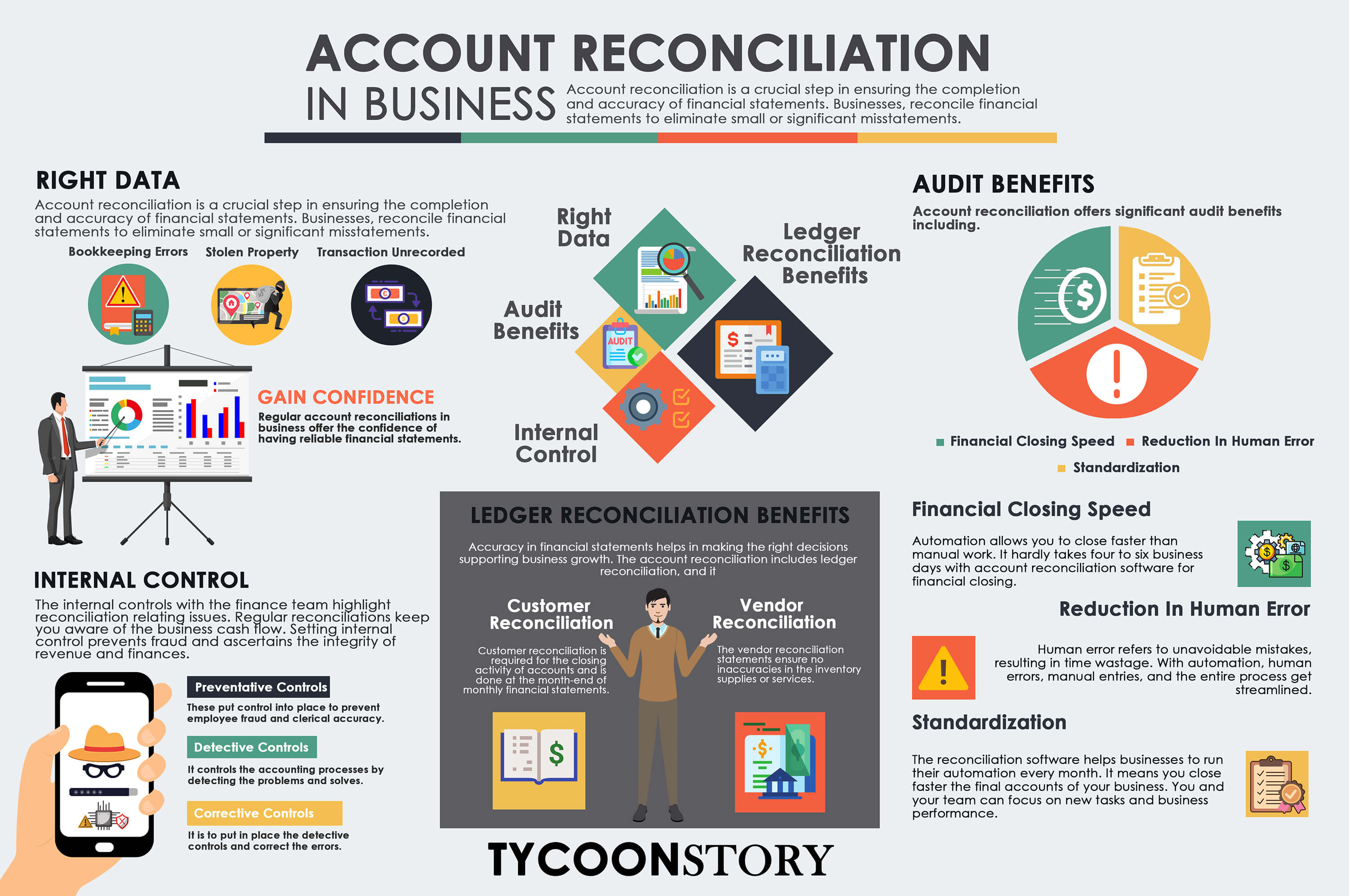

Account reconciliation is a crucial step in ensuring the completion and accuracy of financial statements. Businesses, reconcile financial statements to eliminate small or significant misstatements.

Right data

Reconciliation of accounts is a way of arming yourself with the right data. It is a time-consuming process, but an essential process showing business performance. Through regular account reconciliations, it is possible to identify:

1. Bookkeeping errors

Includes unrecorded expenses and sales or is accounted for multiple times.

2. Stolen property

Payments made to misappropriated inventories and fraudulent vendors.

3. Bank transaction unrecorded

Includes service fees and fund transfers not posted on the right accounts.

Gain confidence

Regular account reconciliations in business offer the confidence of having reliable financial statements. The timely reconciliations help you succeed and spare you from bad decisions. There is a risk at the fiscal year’s end if the process of reconciliation is incomplete. While, account reconciliation gives confidence to the finance team that their information is clear, reliable, and authentic.

Internal Control

The internal controls with the finance team highlight reconciliation relating issues. Regular reconciliations keep you aware of the business cash flow. It helps in identifying clerical errors, fraud, and other hiccups that may affect the business closing process. Setting internal control prevents fraud and ascertains the integrity of revenue and finances. The internal controls include:

Preventative controls

These put control into place to prevent employee fraud and clerical accuracy.

Detective controls

It controls the accounting processes by detecting the problems and solves.

Corrective controls

It is to put in place the detective controls and correct the errors.

Audit benefits

Account reconciliation offers significant audit benefits including:

1. Financial closing speed

Automation allows you to close faster than manual work. It hardly takes four to six business days with account reconciliation software for financial closing. More than 80% of companies do monthly reconciliation.

2. Reduction in human error

Human error refers to unavoidable mistakes, resulting in time wastage. With automation, human errors, manual entries, and the entire process get streamlined.

3. Standardization

The reconciliation software helps businesses to run their automation every month. It means you close faster the final accounts of your business. You and your team can focus on new tasks and business performance.

Ledger reconciliation benefits

Financial data is vital for business success. Accuracy in financial statements helps in making the right decisions supporting business growth. The account reconciliation includes ledger reconciliation, and it includes:

1. Customer reconciliation

It is the process of comparing accounts receivable to outstanding customer balances in the ledger. Customer reconciliation is required for the closing activity of accounts and is done at the month-end of monthly financial statements.

2. Vendor reconciliation

It is the process payable to the vendor’s outstanding balance and account balance, recording discrepancies. The vendor reconciliation statements ensure no inaccuracies in the inventory supplies or services.

3. Inter-company reconciliation

Intercompany reconciliation is for the parent company and its branches to reconcile figures of their engaging transactions. Understanding reconciliation is a must in the normal process, no matter, small or large business. It reveals the cash flow and ensures smooth transactions.

The word reconciliation is to bring together, and account reconciliation is a process of matching bank accounts, transactions, and other records.