INDIA: Now, the government finally has something to show for its pledge. On Saturday, the Ministry of Finance announced that Rs 65,250 crore of illegal income had been disclosed under its income declaration scheme launched on June 1 to encourage Indians to convert their black money into “white”.

Finance Minister Arun Jaitley declared that the scheme was a big success, claiming that over 64,000 declarations had been during the four months. The average worked out to be about Rs 1 crore per individual who participated in the program.

The government stands to receive more than Rs 29,000 crore in tax revenue from these declarations as a one-time windfall, which amounts to about 0.2% of the country’s gross domestic product.

Those who opted for the scheme have to pay 45% of their disclosed income in two installments as a penalty.

Jaitley said the funds collected under the scheme will be used to develop rural areas and infrastructure. The long-term benefit is that thousands of high-income individuals are now under the tax net.

“The objective was to try and make India a more tax-compliant society,” he said. “Tax compliance leads to higher revenues and reduction of budget deficits, and the money collected is spent on infrastructure, the social sector, and rural areas.”

The tax revenue that will be collected is much higher than the amount gathered under previous schemes such as the Voluntary Disclosure of Income Scheme in 1997, which yielded Rs 9,760 crore in tax revenue even though the effective tax rate on the scheme was less than 10%.

However, the latest disclosures still fall way short of matching up to the BJP’s own estimate of the quantum of black money in India.

According to its paper published in 2011, the party said that Indians hold more than Rs 16,75,000 crore in black money, which it claimed it would bring back once in power.

The current declarations are less than 4% of the party’s estimate, proving that there’s a long way to go in plugging the holes in the Indian tax net.

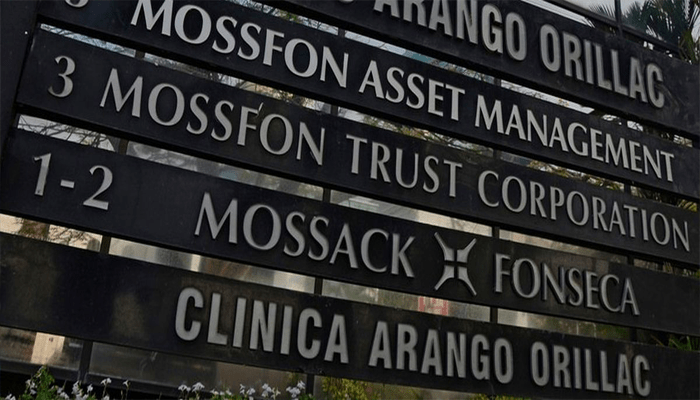

On its part, the government has filed 55 prosecution suits against those named in the Panama Papers leak earlier this year that revealed Indians had made foreign deposits worth Rs 5,000 crore in offshore accounts.

Moreover, it has started prosecution in 164 cases that came up during last year’s HSBC disclosures, which estimated that Indians had stashed Rs 25,420 crore in the bank’s Swiss accounts during 2006-2007.

Meanwhile, the effective tax revenue for the government is more than 60% of the Delhi government’s budget.

The same amount could also be used to power 58 more Mars Orbiter Missions or almost fund the government’s planned spending on the agriculture sector this year.

Even as the government recovers this money, it is yet to fix the Rs 3-lakh-crore hole in the Indian tax net derived from people who have evaded taxes even though they have been officially assessed and are liable for taxes.

Much of this amount is tied up in court cases, some of which have gone on for decades.