Once when you have come up with a great idea and have decided how to register a business company in India, then certainly you must follow some procedures to register your business in India. After deciding regarding registration, naturally, there arise many questions like where should you get the application form, what is the process for registration, what is the registration fee, whom should I contact for making my registration successful.

To get rid of all the confusion, let us help you make your registration process simple and easy with all the necessary details. This article will help you with all the relevant information as a step-by-step procedure for those who have decided to register a business in India or to those who have considering registering a business in India.

Before entering into the registration process, you must be aware of some basic information about the country where you are going to register your business. India is the seventh-largest country with a pool of opportunities in the emerging market for the world. Any business in India will likely succeed in their field because, after the Republic of China, India ranks as the second populated country in the world. To make your registration process easy first, you must gather some information about the country namely; their culture, common business trends and the landscape of India. It will help you decide which part of the country you want to and can register your business. The Indian market trend remains as relationship-oriented.

It is obviously easier for an Indian citizen to register a company in India compared to a foreign country. I am going to list all the official procedures required for registering a company in India.

Let’s start, what is a company?

A company is an association, which is organized and formed to carry out a Business. A company is a legal entity that is classified and should be registered under the company Act 1956. This company Act subdivides the company into two categories called the private corporation/company and Public company.

Let’s Understand What Private Company And Public Company Is

What is a Private Limited Company

Here are the features of a private limited company as follows:

1. A Private company can have a maximum of 50 members.

2. It restricts to transfer his or her shares to anyone.

3. Should not invite the public to subscribe regarding a company share.

4. A private company should have a minimum capital of 1 Lakh Rupees or capital may vary from time to time.

5. The private company should only have two board members and may have two directors.

6. Once a private company is incorporated, it can start its business.

What is Public Limited Company

The characteristic of a public limited company is as follows:

1. There is no limit of members in the public limited company.

2. It can transfer his or her shares to its shareholders.

3. It allows inviting the public to subscribe regarding company shares.

4. The public limited company should have a minimum capital of 5 Lakh Rupees or the capital may vary from time to time.

5. The minimum number of board members required in a public company is seven and must have at least three directors.

6. The company can start its business only after receiving its commencement certificate.

Why Should You Register Your Company?

The main reasons to register your company are as follows

- Protection

- Transferable ownership

- Retirement funds

- Taxation

- Raising funds through the sale of stock

- Durability

- Credit rating

How To Register A Business Company In India

To register a company in India, it may take a duration of about 15 days to a month and sometimes more than that. Every state has a regional office of the Registrars of the company (ROC) to guide the registration process. On white dust, we are going to give a step by step procedure to register a company, especially in India.

Steps To Register A Company In India

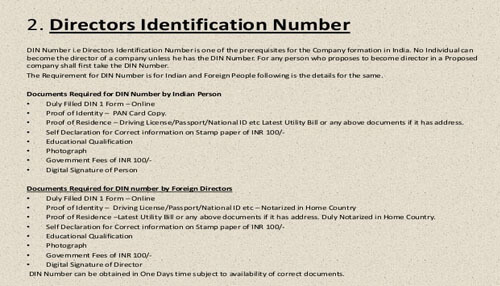

Step 1: How To Obtain The DIN (Director Identification Number)

First and the first process in registering a company is to acquire a DIN for directors. The government has set new requirements under which directors for an Indian company, in which both an Indian and a Foreigners must register and get a unique identification number. It called as DIN(Director Identification number). The Ministry Of Corporation Affairs (MCA) issues DIN, which is a unique identification number for an existing director or to the person who is intended to become a director of the company. Even if a person severs as a director to many companies only one DIN is allotted to a particular individual. For every director, company DIN has been made compulsory according to the Amendment Act 2006.

The Ministry Of Corporation Affairs (MCA) identifies the directors of the company by using this DIN. The process takes approximately one or two days with a registration fee of 100INR.

Here are the Mandatory Documents required:-

- Identity Proof

- Passport

- Driving license

- Voter ID

- PAN card

- A photograph is a must

- Address Proof

- Ration card

- Bank statement

- Electricity Bill

Steps to fill the E- form for obtaining DIN:-

1. Create a login ID with a username and password on the MCA website (mca.gov.in).

2. After creating an account with MCA. Log in to your account and fill the E- Form to generate your DIN.

3. Download the E-form DIN-1 and fill it with the necessary details.

4. Procedure to fill the DIN 1 form:

a. Enter the full name of the applicant and make sure not to use abbreviations.

b. Enter your father’s name even if the woman is married.

c. Select the options whether you are a citizen of India or not.

d. Attach the latest photograph of the applicant in the box provided. The full face of the applicant should be clear. It should be in JPEG format.

e. Enter the nationality as mentioned in your passport.

f. Specify your current occupation and your education qualification.

g. Enter your date of birth in the given format (date- month-year).

h. Specify your gender by selecting one of the two options.

i. Enter your place of birth

j. Enter your Pan card number. Once it is entered it will highlight the “Verify income tax PAN details “ button click on it to verify.

k. Enter your Voter’s Id number, Passport number and Driving license number in the next fields.

l. Enter your permanent address including your city, state, pin code, country, ISO country code, mobile number, E-mail, Fax, telephone number.

m. Select one of the two options whether the present and the permanent address is the same. If the address differs, please mention it below in the next field.

n. Select the relevant checkboxes in the Certification field.

o. Attach the required documents as referred to in the form.

p.Select the appropriate category of the person who has signed your e-form either a Notary public or Gazette Officer of a government.

q. Enter the corporate identity number (CIN) of the company with which the Secretary is associated with the company and in which the applicant is proposed to be a director. Click the pre-fill button. The system will automatically display the name of the enterprise.

r. Check your e-form is successful, required documents are attached, pre-scrutinize your e-form and then submit it.

5. After uploading the DIN 1 form, it will generate the DIN for the director. After generating the DIN one should intimate to their company about DIN by using DIN 2 form

6. Details to be entered in DIN2 form are listed below:

a. In the TO address field enter the company name and the address of the company.

b. Enter the date

c. Enter your DIN number

d. Enter your name

e. Enter your father’s name

f. Enter your residential address

g. Enter your email ID

h. Enter your designation

i. Specify whether chairperson or director or executive director

j. Determine the category, name of the company and date of appointment.

k. Enclose a copy of the DIN allotment letter.

7. The next process is that the company should intimate regarding the director’s DIN to the Registrar Of Corporates (ROC) through DIN 3 form

8. Details to be entered in DIN3 form are as follows:

a. Enter the Corporate Identity Number (CIN) of the company

b. Click the prefill button by which the system automatically displays the name.

c. Enter the address of the company and the e-mail id of the company.

d. Enter the authorized capital of the company, some members of the company.

e. Enter the paid capital of the company and enter the total number of directors and managing directors of the enterprise.

f. Enter the DIN number of the director and click the prefill button.

g. Then the system will display the personal details of the director. Enter the date when the intimation received from the Director in Form DIN 2.

h. Select the designation and the category of the director like the chairperson, executive or nonexecutive.

i. Enter the DIN of the director if you have chosen an alternative director.

j. Enter the details of the director like the name of the company, email id and the date of appointment.

k. Provide the details of the manager like name, address, e-mail, designation, and date of appointment.

l. In an optional attachment, you can provide any other information.

m. Enter the date in which it has been authorized by the board of directors and submit the form.

n. The e-form should be digitally signed by the managing director or manager or director of the company, mention their designation and DIN.

o. The certificate should be digitally signed by the company secretary and enter his designation and membership number.

p. Check the form by clicking the form check button, if you want to modify anything modify it using the modify button. A then upload the filled form.

q. If you want to update your personal details or change of address or any change in DIN, then the director should intimate the change by submitting the e-form DIN 4.

This above Image Source: Slideshare.net

Step 2: How to Obtain Digital Signature Certificate (DSC)

The documents should submit in an electronic format for Digital Signature Certificate. Digital Signature ensures the documents security and authenticity. Indian company Directors are required to get a DSC. The agencies that have been appointed by the Controller Of Certificate (CCA) should authenticate the Digital Signature Certificate. The digital signature validity is within one or two years. Once when it expires, we should renew it. The time taken to complete this process is a minimum of 1 to 6 days. The registration fee may vary from 400 to 2650.

Step 3: Reserve the Company name with ROC

First, you have to decide a unique name to register your company in India and get approved from ROC. The company name registration process starts with filling the application Form 1A which is available at the ROC office of every state. The necessary documents you should provide are the address proof of the company that you have to register, name and signature of one of the directors. So you have to suggest five unique, different names because the ROC staff will search for the availability of company name in India.

If the business name that you have suggested is not approved, then you will be given a chance for resubmission of the new panel of names against the fee paid. It may take 2 to 3 days to complete the process and the registration fee is RS 500.

Here are the Steps to fill Form 1A:-

1. Select from the two options whether the application is meant for incorporating a new company or changing the name of the existing company.

2. Provide the details of the applicant like his DIN or PAN card number or Passport number. Click the prefill button. Then the system will automatically display the name and the address of the applicant if you have provided your DIN number. If you provide your PAN or Passport number, then you have to fill the details.

3. From the given categories select the type of your company, state whether the company proposed is private or public.

4. Select whether the proposed company has a share capital or not.

5. Enter the state in which the proposed company is to be registered.

6. Enter the name of the office of the registrar of the companies in which the proposed company is to be registered.

7. Enter the number of promoters and details of the promoters like his category, DIN and Name.

8. Suggest six alternative names for the company to be registered. Please give the name in the order of preference.

9. Explain the significance of the proposed name of the company in a few words.

10. Enter the primary objects of the proposed company to be included in MOA.

11. Enter the proposed authorized capital.

12. Enter the particulars of 2 directors like their DIN, name, father’s name, nationality, PAN number, and address.

13. Verify it and upload the form.

Step 4: Memorandum And Articles Of Association Vetted And Printed

The Memorandum Of Association contains information about the company’s main objective. The document should include the information regarding what is the capital amount that you want to raise by issuing shares and the purpose for which the capital will be used in the present and future.

The Articles Of Association contains information regarding the then companies’ daily operations. In the form INC-29, both the Memorandum Of Association and Article Of Association should be attached. With the ROC of vetting, you can file these draughted documents Online. Then print the documents and get notarized once the ROC approves your MOA and AOA. This process has to be done within six months of the name approval. There is no registration charge.

Step 5: The companies documents should be stamped

The companies documents should be stamped either at the superintendent or an authorized bank.has made mandatory to pay all the stamp duties for all the incorporated company forms and documents online via www.mca.gov.in website. The charge may differ from state to state and it may take one day to complete this process.

Step 6: Documents Should be Signed

Each and every document of Memorandum Of Association and Articles Of Associations should sign by at least two members of the company in their handwriting and one witness should be there for signature. It may take a day to complete the process.

Step 7: To Get Certificate

The next step is to get the Certificate Of Incorporation from ROC and MCA. It may take a week or more and the cost may differ depending upon the companies authorized capital. Example: the cost is 4000 firs the company capital of Rs 1 lakh.

Step 8: Ensure The Legality

Make a Seal ensure the legitimacy of the companies document. A company should stamp its document with its unique company seal. It may take a day of time to complete the paper and the cost is 350 Rs.

Step 9: To Get Pan Number

Next you should obtain the Permanent Account Number (PAN) from UTI or NSDL. It may cost around 60 to 70 and take 15-20 days to time to complete the process.

Step 10: To Obtain Tax Number

Obtain the Tax Account Number (TAX) from the income tax. TAN is a ten-digit unique ten-digit number required for the people who are responsible for deducting tax at a source. It may take 15 days of time to obtain TAN and its cost is around 55INR.

Step 11: Registration for VAT

With the Sales Tax Officer, you must register for VAT. The VAT is a Value Added Tax, which requires registration by filing Form 101. The time duration to complete this process is 12 days and the cost is around Rs.5000 plus its stamp duties of Rs.100

Step 12: Registration for Professional Tax

Next is to register for Professional Tax from the Profession Tax Officer of the state. Register the employees with the provident fund organization. It may take 2 to 3 days and its free of cost.

Step 13: Identified With An Individual Record

Each employee of the company should be identified with an individual record for Medical Insurance Scheme. The employer should register Form 01 with is sent as per Employee State Insurance. It may take 2 to 3 days of time for issuing the Employer Code Number.

Step 14: Government Approval

The last step is filling for government approval before RBI/ FIPB for foreigners and NRIs. It may take 15 days to complete the process.

If you were having any queries regarding the registration of your company, then feel free to contact us for all types of help. Our experts will surely help you to get rid of your problem in a minute.

Visit These Websites with Simple Registration: