A mortgage loan is ideal for building owners when they want to overcome the financial burden during emergencies. It is a loan against a property allowing individuals and businesses to overcome unwanted problems. However, one should keep certain things in mind when he/she wants to purchase a loan from a bank. Mortgage calculators allow property owners to know the repayments and other details when they want to buy a loan.

Different types of mortgage calculators are available in the markets today and one should evaluate them with more attention. They even allow a person to know what the factors that can affect mortgage payments. So, the money view bridging loan calculator can helps to know the interest rate, eligibility criteria, and loan amounts.

Choosing The Best Mortgage Calculators

1. Zillow

Zillow is an online calculator that lets users calculate the mortgage with a wide range of options. It is an easy-to-use tool that provides ways to make the right decision while purchasing a loan. Homeowners should enter certain details on the calculator such as amount, duration, property price, etc.

If you’re a homeowner in Florida who is considering a reverse mortgage, you might find it helpful to use a florida reverse mortgage calculator. The calculator also helps to know whether a borrower has to pay insurance and taxes or not in detail. Moreover, it even offers an option for homeowners to get a pre-qualified mortgage loan that suits their income. Those who want to customize the details can use this tool because it gives ways to proceed further.

2. Trulia

Trulia is one of the home mortgage calculators that offer some appealing features for users while calculating the amount. It has a zipcode that gives ways to calculate the local taxes with high accuracy. Not only that, the calculator enables customers to estimate mortgage loans on non-traditional homes. Homeowners can even decide how much they can spend on mortgage loans while buying them.

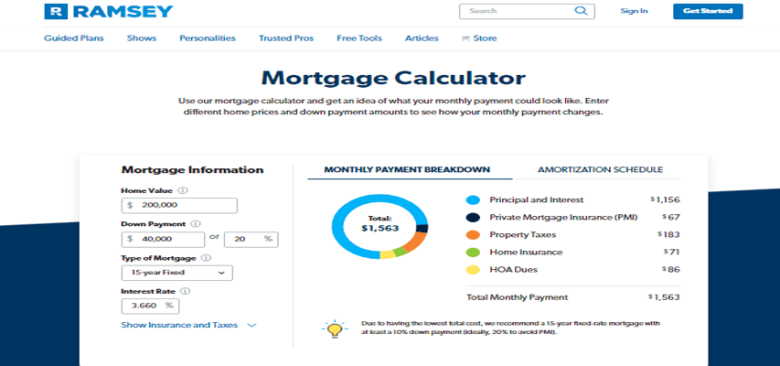

3. Ramsey

Ramsey is another online mortgage calculator that allows customers to determine the monthly mortgage payment and total mortgage easily. The tool also gives ways to find a local real estate agent with ease to get the best deals. It makes the mortgage process a simple one by addressing the needs of users. Anyone who wants to know the mortgage amount should enter certain details that will help gain more ideas.

They can enter different home prices and down payment amounts which gives ways to know the changes in monthly payments. This calculator will break down the information while calculating the amount. Some of them include private mortgage insurance, property taxes, home insurance, HOA dues, principal, and interest.

4. Veterans United

Veterans United is a simple mortgage calculator designed for current and former members of the US army. The tool allows users to go through the entire process of calculating home loan costs. Apart from that, it provides ways to calculate everything including insurance and other things with high accuracy. A veteran can also know whether he/she is eligible to get the loan or not based on the credit score.

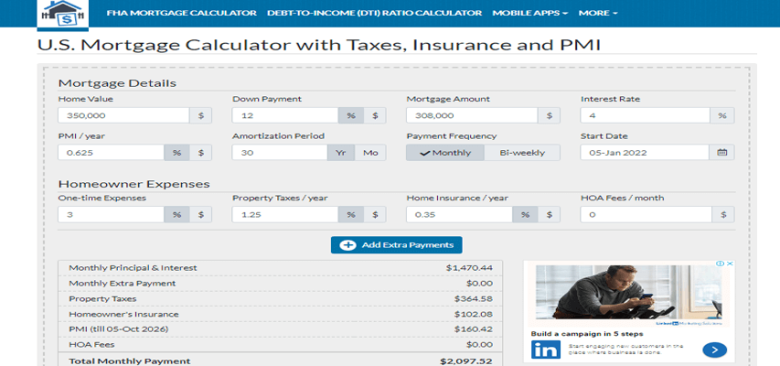

5. US mortgage calculator

This is one of the home mortgage calculators that allow customers to calculate the FHA loans. The FHA loan limits vary in various states across the US, this tool helps to calculate the same accurately. Besides that, the calculator is suitable for homeowners who want to know the monthly payments and other things in detail.

6. Rocket Mortgage

Rocket Mortgage is a simple mortgage calculator that allows customers to buy a loan depending on their requirements. It makes feasible ways to estimate the monthly mortgage payment with ease. Homeowners who want to calculate the amount should enter certain details. Some of them include home price, interest rates, location, down payment amount, duration, etc. This calculator enables a person to calculate the taxes and insurance after entering the zip code.