In today’s busy world, it’s obvious that looking after our health and picking the right health insurance plans aren’t just smart choices for us; they’re like putting money into a better future for our family too. It’s like deciding to be in charge of our health—an important promise that works well.

Yet, amidst the whirlwind of life, how do we ensure we secure top-notch healthcare? That’s where health insurance steps up, like a safety net to catch us if unexpected medical expenses come our way. And guess what? There’s an even cooler aspect to it: quality health insurance goes beyond that.

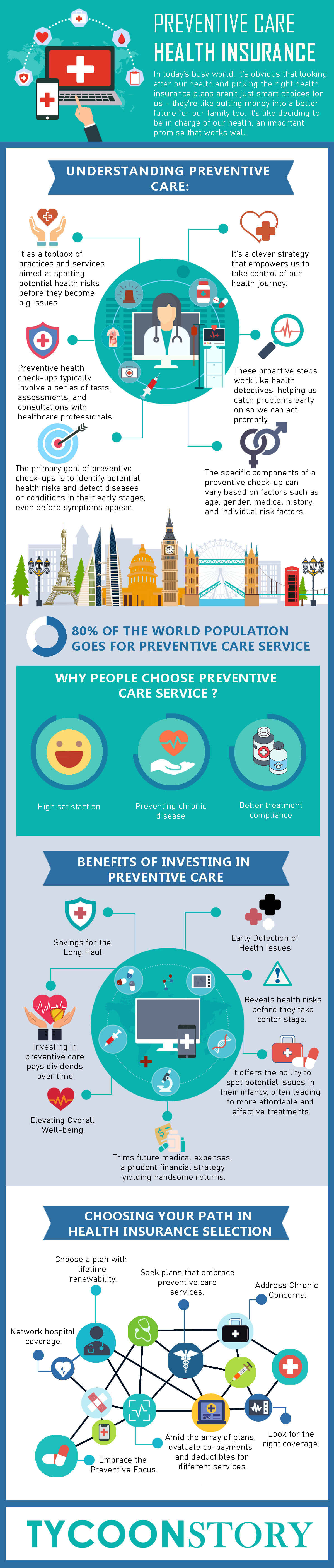

Understanding Preventive Care: Your Path to Well-being

Preventive care is more than a trendy term; it’s a clever strategy that empowers us to take control of our health journey. Imagine it as a toolbox of practices and services aimed at spotting potential health risks before they become big issues. Think vaccinations, cancer screenings, and regular check-ups. These proactive steps work like health detectives, helping us catch problems early on so we can act promptly.

Health Insurance: Your Partner in Preventive Care

Think of health insurance as your dependable friend, giving you access to a treasure trove of preventive care services. Many top-notch health insurance plans cover essential preventive measures like vaccinations, cancer screenings, and regular check-ups. But these aren’t just services – they’re like tools in your arsenal to stay well-informed and a step ahead of possible health issues.

Benefits of Investing in Preventive Care

The rewards of investing in preventive care ripple through various facets of our well-being and our future:

1. Early Detection of Health Issues:

Imagine having a crystal ball that reveals health risks before they take center stage. That’s the essence of preventive care – it offers the ability to spot potential issues in their infancy, often leading to more affordable and effective treatments.

2. Savings for the Long Haul:

Just as we invest money for future gains, investing in preventive care pays dividends over time. These measures are like a magic wand that trims future medical expenses, a prudent financial strategy yielding handsome returns.

3. Elevating Overall Well-being:

Health is the foundation of well-being. By proactively managing our health, we directly elevate our overall quality of life.

Choosing Your Path in Health Insurance Selection

Picking the right health insurance plan is like finding the perfect fit for a puzzle piece. Here’s a guide:

1. Embrace the Preventive Focus:

Seek plans that embrace preventive care services like immunizations, cancer screenings, and regular check-ups. This shows a commitment to your holistic well-being.

2. Address Chronic Concerns:

If you’re dealing with pre-existing conditions or anticipate treatment for chronic illnesses, ensure your insurance covers these needs.

3. Cost Consideration:

Amid the array of plans, evaluate co-payments and deductibles for different services. Balancing affordability with comprehensive coverage is the sweet spot.

In Conclusion

Today’s choices etch our future story. Investing in a healthier, happier life isn’t just a monetary commitment – it’s an investment in ourselves and our cherished ones. Preventive care, interwoven with the protective embrace of health insurance, shapes a life lived fully. By fostering a culture of proactive health management, we pave the road to longevity and a life enriched by vitality and well-being. For more insights on health insurance options, you can explore www.Medicareadvantageplans2024.org.