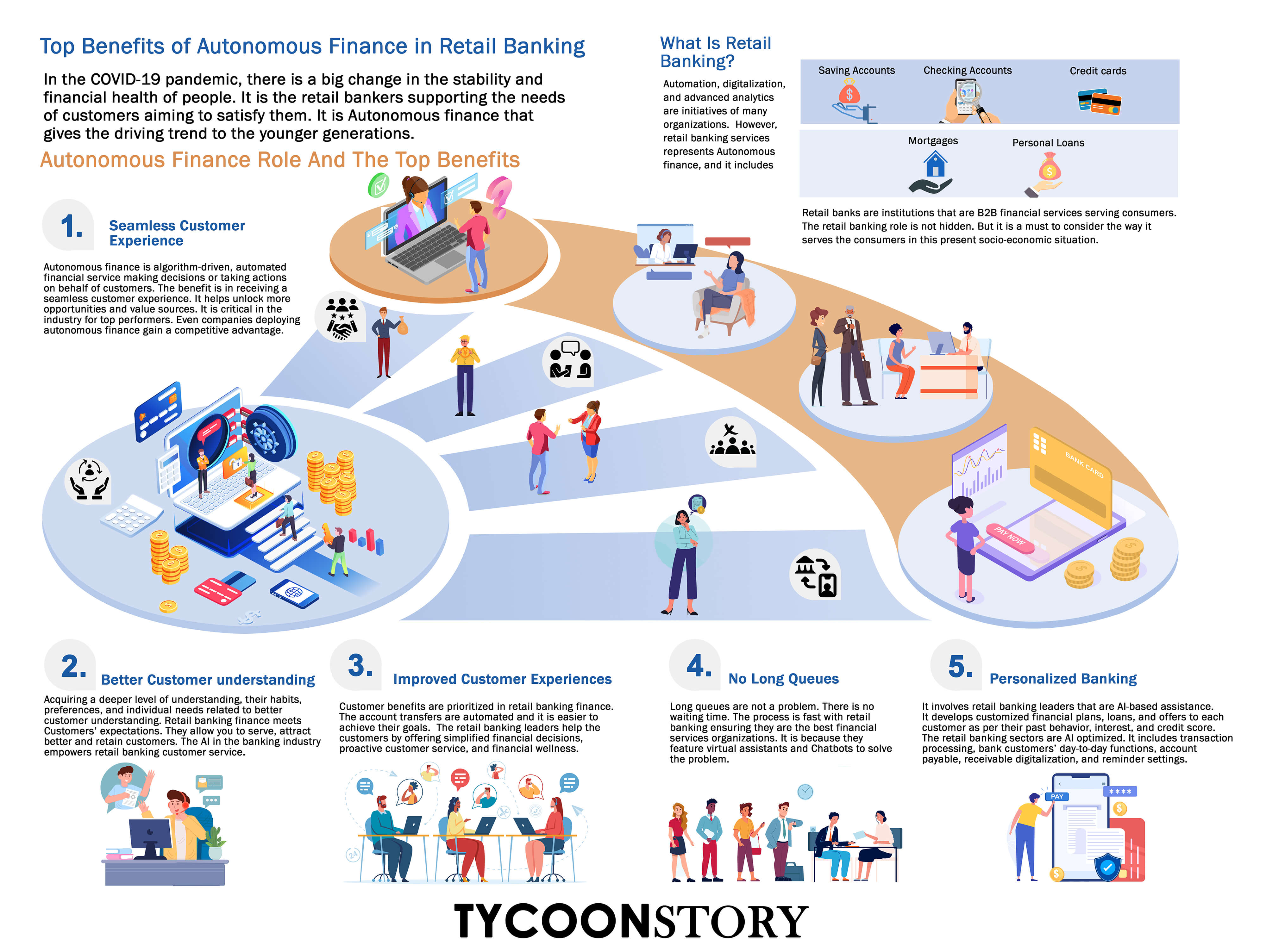

What is retail banking?

Automation, digitalization, and advanced analytics are initiatives of many organizations. However, finance in retail banking services represents Autonomous finance, and it includes:

- Saving accounts

- Checking accounts

- Credit cards

- Mortgages

- Personal loans

Retail banks are institutions that are B2B financial services serving consumers. The retail banking role is not hidden. But it is a must to consider the way it serves the consumers in this present socio-economic situation.

In the COVID-19 pandemic, there is a big change in the stability and financial health of people. It is the retail bankers supporting the needs of customers aiming to satisfy them. It is Autonomous finance that gives the driving trend to the younger generations.

Autonomous finance role and the top benefits

Seamless customer experience

The key to retail banking’s future relies on these financial services organizations. Autonomous finance is algorithm-driven, automated financial services making decisions or taking actions on behalf of customers. The benefit is in receiving a seamless customer experience. It helps unlock more opportunities and value sources. It is critical in the industry for top performers. Even companies deploying autonomous finance gain a competitive advantage.

Better customer understanding

Acquiring a deeper level of understanding, of their habits, preferences, and individual needs related to better customer understanding. Retail banking finance meets Customers’ expectations. They allow you to serve, attract better, and retain customers. The AI in the banking industry empowers retail banking customer service. The AI-based tools affect customer service and help customer representatives.

Improved customer experiences

Customer benefits are prioritized in retail banking finance. The account transfers are automated and it is easier to achieve their goals. Retail banking leaders help customers by offering simplified financial decisions, proactive customer service, and financial wellness. Automating and streamlining the processes of the back office helps retail banking spend more time handling revenue-generating tasks. The automatic handling of finance ensures the ease of handling finance.

No long queues

Long queues are not a problem. There is no waiting time. The process is fast with retail banking ensuring they are the best financial services organizations. It is because they feature virtual assistants and Chatbots to solve the problem. Thus, allows patrons to do bank-related things from their home comfort.

Personalized banking

It involves retail banking leaders that are AI-based assistance. It develops customized financial plans, loans, and offers to each customer as per their past behavior, interest, and credit score. The retail banking sectors are AI-optimized. It includes transaction processing, bank customers’ day-to-day functions, accounts payable, receivable digitalization, and reminder settings.

Smart Insights

The cash flow patterns analyze the end-user behaviors to showcase users’ spending patterns and generate reports. AI recommends services and products to customers relating to earlier behavior of the customers. The chatbots help individuals in the retail banking sector enjoy cost savings. The smart insights and the data are driven using AI.

Quick Resolution time

Chatbot conversations are helpful, and this is an exceptional benefit saving the agent’s time and meets Customers’ expectations. It saves agents time and enables a free flow of information. It enables financial organizations and banks to integrate automatically with their self-help library. The chatbots automatically route their customers in handling complex queries by leading them to live agents. Autonomous finance in retail banking is the key to delivering the best customer experience. It can satisfy the customers today with their retail banking needs and in reaching the dynamic generation. It helps in opening doors for opportunities.