Venture Capital is an institutional or private investment that is offered to “new” businesses at an earlier stage. These investments prove to be useful when the business doesn’t have adequate funds to support its operations. Every venture capital comes with risks. However, investors make decisions with “confidence” that the new venture will grow, and make profits. Most of the time, venture capital is invested in ventures that are small, or mid-sized. People who choose to make the investment are known as venture capitalists. During the process, the venture capitalist chooses to buy shares of the new business. As a result, they become financial partners of the startup.

Venture capitalists are often known for taking big risks. If the business fails to make an impact and generate revenue – the investors are going to lose lots of money.

How are Venture Capitalists formed?

Most of the time, venture capital is generated from individuals with very high worth, or institutional investors. The money is carefully pooled together, with the help of investment firms that are dedicated to achieving this job. Venture capital is a suitable form of funding when the capital requirements of the business are high upfront. Also, if a business doesn’t find money through cheaper alternatives, venture capitals come handy. Intellectual properties and software companies commonly rely on the support of venture capitalists. Mainly because the net worth of these companies is not proved.

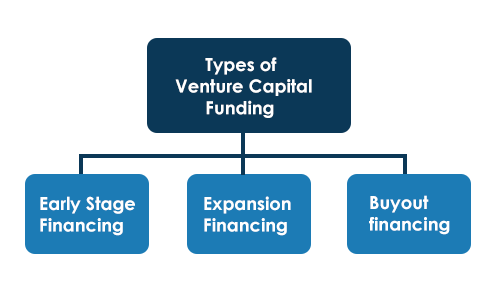

Types of Venture Capital Funding

There are several different types of venture capital funding. These types can be carefully classified based on the stage of the application, and the complexity of the business. Three important types of venture capital would be:

- Early Stage Financing

- Expansion Financing

- Buyout financing.

Regardless of the financing methods, the venture capital funding strategy involves six important stages:

- Seeding money

- Startup

- First round of financing

- Second round of financing

- Third round of financing

- Fourth round of financing

Now, let’s understand more about the different types of venture capital funding methods.

#1 Early Stage Financing

As suggested by its name, the funds are offered to businesses which are in its early stage. These companies need money to even kick start operations. Without the support of venture capitalists, it would be rather difficult for the company to even exist. Early-stage financing is often broken into three different categories:

- Seed financing: During this stage, a small amount of money is offered to the business owner. Using this amount, the entrepreneur will become eligible for a bank loan.

- Startup Financing: This kind of fund is offered to companies that need to finish the development of their products or services.

- First stage financing: When a startup has exhausted its initial capital, they are bound to need additional funds for executing their business. Now, the business is running in full-scale. Thus, they become beneficiaries of the venture capital, first stage funding.

#2 Expansion Financing

Expansion financing falls in the category of second-stage financing. In some cases, it can be treated as mezzanine financing or bridging financing.

Second stage funding is offered to businesses that are keen on expanding their operations. This is why the financing strategy is also known as mezzanine financing. It is always offered when the business showcases a sign of purpose and growth. However, venture capital investment may come with a nominal rate of interest.

#3 Buyout or Acquisition Financing

The last type of venture capital would be a buyout or acquisition financing. This kind of funding is useful with a company wishes to buy another venture or few parts of another business.