Monarch Money is a modern financial management platform that gives you a complete picture of your financial status. It connects with thousands of banks and institutions, so you can see all your accounts, investments, and plans in one place.

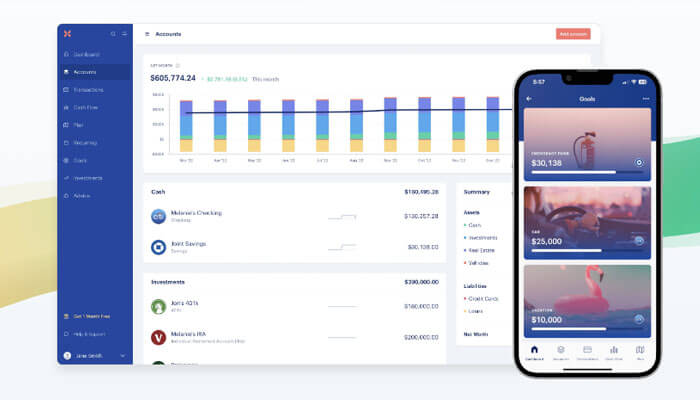

Monarch Money uses cutting-edge technology to provide an all-in-one solution. You can track balances, transactions, and investments across accounts to gain valuable insights into your financial well-being. The platform incorporates AI to analyze your finances and provide personalized guidance on achieving your goals.

With cutting-edge features and technology, Monarch Money is an all-in-one platform that can help you take control of your finances and build wealth. Monarch Money aims to simplify financial management and provide the insights and education you need to progress toward your goals. On that note, here is a comprehensive Monarch Money review.

What Are Monarch Money’s Key Features?

Monarch Money gives you a complete picture of your finances in one place. Their platform integrates with over 11,000 banks and institutions, pulling all your accounts, investments, and transactions into a single dashboard.

Some of the key features that make Monarch Money so useful are:

1. A portfolio overview:

See the performance and allocation of all your investment holdings at a glance. Track how your portfolio is balanced across asset classes like stocks, bonds, real estate, and cash.

2. Customizable budgets:

Set spending limits and get notified when you exceed the budget. Monarch Money helps get you back on track to achieve your financial goals.

3. Transaction monitoring:

Monarch Money’s transaction notification system shows you exactly where your money goes each month. This will help you catch fraudulent charges quickly and identify subscriptions you no longer need.

4. Well-done reports:

Monarch Money provides interactive charts, graphs, and dashboards that give insight into your cash flow, net worth, returns, and more. See trends over time and visualize your financial health.

5. Bank syncing:

Link all your financial accounts, including checks, savings, credit cards, investments, mortgages, and loans. Monarch Money automatically updates your balances and transactions daily, giving you an accurate financial snapshot.

With robust features focused on budgeting, reporting, monitoring, and planning, Monarch Money gives you control and clarity over your finances. Their platform simplifies managing your money and even helps you save and invest for the future.

What Are Monarch Money’s Pricing Options?

Monarch Money offers two straightforward pricing plans for their budgeting app: Basic and Premium. The Basic Plan is free to use and includes core features like creating budgets, tracking expenses, and monitoring your accounts. This is perfect if you want a simple overview of your finances without the bells and whistles.

For $9.99 per month or $89.99 billed annually, the Premium Plan unlocks extra tools like bill pay, custom reports, and investment tracking. There’s also a two-week free trial to test it out risk-free. The Premium Plan is worth considering if the advanced features are useful for gaining insights into your money habits and planning for future goals.

Whatever option you choose, your data and accounts are kept private and secure. Monarch Money does not share or sell your information to third parties. Upgrading or downgrading plans is easy and can be done anytime through the app.

Who is Monarch Money’s ideal customer?

Monarch Money’s ideal customer is anyone seeking better financial insight and control. Whether you’re an individual, couple, family, investor, or business owner, Monarch Money has versatile features for people at any stage of life or career.

Monarch Money aims to serve anyone who wants clarity, insight, and control over their financial well-being. Whether you have complex or straightforward needs, Monarch Money puts the power of managing your money at your fingertips.

What is Monarch Money’s competitive edge?

With so many personal finance apps available (like Playbook, Tiller Money, and PocketSmith), what gives Monarch Money its competitive edge? A few key factors set it apart:

1. Monarch Money provides a comprehensive yet customizable view of your financial life. See all your accounts, budgets, goals, and transactions in one place. Toggle between overviews, details, and charts to get the level of insight you need.

2. Collaborative financial planning is a breeze. Add a spouse, partner, or family member to your Monarch Money account to work together on shared budgets, saving goals, and major financial decisions.

3. Set customized goals, and Monarch Money will calculate how much you need to save each month to achieve them. Want to save for a down payment on a house or pay off student loan debt? Monarch Money has your back.

4. The dashboard gives you an at-a-glance summary of your financial status with charts and graphs that are easy to understand. Customize your dashboard by adding or removing accounts, budgets, or goals to focus on what’s most important to you.

5. Robust budgeting tools make it simple to allocate your income to essential expenses. Set budgets, get alerts if you’re overspending, and move money between categories as needed. Monarch Money does the math for you.

6. Security and privacy are top priorities. Monarch Money uses bank-level security and encryption to keep your data safe and only shares information at your request. They don’t sell user data or run ads to generate revenue.

With its unique combination of useful features, intuitive design, and dedication to user experience, Monarch Money delivers a competitive personal finance solution focused on what matters to you. Monarch Money can help reduce stress and increase your financial well-being by providing financial clarity and control.

Monarch Money Review: Pros and Cons of Using Monarch Money

Monarch Money is a popular budgeting app with pros and cons, like any product. Before diving in, it’s important to consider both the advantages and disadvantages of the platform to determine if it’s the right budgeting tool for your needs. Here are some of Monarch Money’s pros and cons based on online Monarch Money reviews:

Pros

1. Seamlessly syncs with over 11,000 banks and institutions.

2. Enables joint management of finances.

3. Offers comprehensive investment tracking capabilities.

4. Provides customizable financial visualizations.

5. Boasts robust budgeting features.

6. Utilizes bank-level security measures.

Cons

1. It may be overwhelming for beginners due to its extensive features.

2. Not suitable for individuals who prefer passive budgeting tools.

Is monarch money worth it?

This app goes way beyond basic budgeting. It seamlessly integrates with thousands of financial institutions, providing a comprehensive picture of your finances in one place.

Monarch Money provides a complete financial management solution for individuals, families, couples, investors, and anyone looking to gain control of their money. Its intuitive interface and wealth of features make it easy to see your financial picture and make informed decisions.

For a few dollars a month, Monarch Money is an investment that will pay off through better insight into your money and smarter financial choices. Give it a try—you have nothing to lose and everything to gain.