All you need to know about a super-top-up health insurance policy

We have all come across the saying – health is wealth, and it has never been as true as it is today. Fast-paced yet sedentary lifestyles, poor eating choices, and rising costs of healthcare impact our quality of life and the treatment we seek. Untimely and unplanned health costs can adversely impact our finances and, at times, stop us from seeking the best treatment. A health insurance policy in such times of medical emergencies offers peace of mind as well as the much-required financial net.

While a health insurance policy can provide added protection, the premiums are not particularly cheap. Given that we all want nothing but the best, we all want additional benefits and higher coverage with our health insurance at affordable rates. While getting additional benefits at affordable premiums may be a challenge, there is a way to get extra coverage without burning a hole in your pocket.

Do you need a super-top-up health insurance policy

Understanding a super top-up health insurance

A super top-up health insurance policy may sound similar to a health insurance top-up. However, the differences between both are plenty. A super top-up comes with additional benefits that go beyond the top plan benefits.

Super top-up health insurance provides additional coverage over and above the coverage offered by your health insurance policy. This helps you with the cost of hospitalisation in case your health insurance coverage is exhausted or you need to pay from your own pocket. While a top-up plan pays only once in a policy period, a super top plan can help with several claims throughout the year.

So those looking for benefits of the best health insurance in India can choose a super top up plan to expand the coverage and keep the costs affordable.

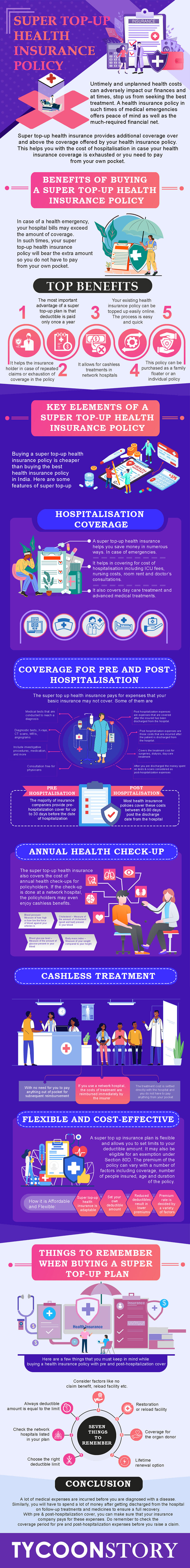

Benefits of buying a super top-up health insurance policy

Consider super top-up insurance as an extension to your existing health insurance policy. In case of a health emergency, your hospital bills may exceed the amount of coverage. In such times, your super top-up health insurance policy will bear the extra amount so you do not have to pay from your own pocket.

Even if you purchase the best health insurance in india, you may sometimes feel your current plan does not provide adequate coverage. With super top-up insurance, you can increase the coverage amount without impacting the benefits of your existing health insurance policy.

1. It helps the insurance holder in case of repeated claims or exhaustion of coverage in the policy.

2. The most important advantage of a super top-up plan is that deductible is paid only once a year.

3. It allows for cashless treatments in network hospitals.

4. Your existing health insurance policy can be topped up easily online. The process is easy and quick.

5. This policy can be purchased as a family floater or an individual policy.

Key elements of a super-top-up health insurance policy

Buying a super top-up health insurance policy is cheaper than buying the best health insurance policy in India. Here are some features of super top-up:

1. Hospitalization coverage:

A super-top-up health insurance plan helps you save money in numerous ways. In cases of emergencies, it helps in covering for cost of hospitalization, including ICU fees, nursing costs, room rent and doctor’s consultations. It also covers day treatments and advanced medical treatments.

2. Coverage for pre and post-hospitalization:

The super-top-up health insurance pays for expenses that your basic insurance may not cover. Some of them are the cost of pharmaceuticals, diagnostic tests, follow-up examinations, etc. Additionally, any expenses within one month prior to hospitalization and two months post-discharge can also be reimbursed under this plan.

3. Annual health check-up:

The super-top-up health insurance also covers the cost of annual health check-ups for policyholders. If the check-up is done at a network hospital, the policyholders may even enjoy cashless benefits.

4. Coverage for organ donors:

A super top-up health insurance policy covers payments to organ donors which can prove to be a lifesaver as such costs are hard to bear from your open pocket.

5. Family floater plan:

A family floater plan included in super top-up health insurance covers the medical expenses for the entire family with a single payment.

6. Cashless treatment benefits:

If you get treatment in a network hospital, the treatment cost is settled directly with the hospital and you do not have to pay anything from your pocket.

7. Flexible and cost-effective:

A super top-up insurance plan is flexible and allows you to set limits to your deductible amount. It may also be eligible for an exemption under Section 80D. The premium of the policy can vary with a number of factors including coverage, number of people insured, age, and duration of the policy.

Things to remember when buying a super top-up plan

1. Choose the right deductible limit when buying a super top-up health insurance policy.

2. Do remember to check the network hospitals listed in your plan.

3. Ensure the deductible amount is equal to the limit set by your base insurance policy.

4. Consider factors like no-claim benefits, pre- and post-hospitalization cost, lifetime renewal option, reload facility, etc.

Super top-up health insurance is easy to purchase and offers a variety of benefits including extending your existing coverage. With rising medical costs and uncertain situations like the pandemic, having a comprehensive super top-up health insurance policy over and above the best health insurance policy in India is critical and offers a significant amount of financial coverage.

If the amount of coverage by your existing policy is not sufficient considering the medical needs and existing illness of your family members, a super top-up medical insurance plan can help bridge the gap. This plan is a cost-effective way to meet the exceeding medical bills.

Disclaimer: The above information is for illustrative purposes only. For more details, please refer to the policy wordings and prospectus before concluding the sales.