PBC is a six-digit number to classify the major product/service types that you sell/offer. This code is mainly used to file federal tax returns associated with the IRS (Internal Revenue Service). It is also mandatory for identification purposes in the U.S. government and when applying for loans with SBA (Small Business Administration).

About principal business code

For any organization, its business activity is what determines its code. It is the one that generates optimum revenue. The United States Census Bureau states that the code is determined generally by the highest relative share. This relates to capital investment or production costs. However, in reality, it is employment or revenue that determines it.

The NAICS (North-American Industry Classification System) determines the codes. It was jointly developed by the Canadian, United States & Mexican governments. After every 5 years, it is updated and got updated last in 2017.

How does the code function?

The business activity code schedule is present within the instructions provided for Schedule C of the IRS. Using this profit or loss is reported from single-member LLC or sole proprietorship. It also is used in instructions meant for various business tax forms. Check out the NAICS Association site for the correct code.

The code’s initial two digits represent categories like Manufacturing (31-33) & Hunting, Fishing, Forestry & Agriculture (11). These categories have been alphabetically within the Schedule C instructions & in numerical order on the NAICS site.

You can get hold of a description in the category to fit perfectly your business requirements. In case, you are a coffee shop owner, for instance, visit the Accommodation, Drinking Places & Food Services category. ‘Non-alcoholic beverage & Snack bars’ is perhaps, the right description for your coffee shop, with the code 722515.

How to derive IRS business codes?

Firstly, businesses provide information to government agencies. The latter uses the PBCs to assign the code with this information. Hence, you can derive the types of principal codes that you would like to have. For instance, principal codes are assigned by the ‘Social Security Administration’ to any new business. This is done during the application for EIN (Employer Identification Number). Again business activity code is assigned by the Census Bureau as the entrepreneurs respond to surveys. Also, it is assigned by the Labor Statistics Bureau on being contacted by a business about unemployment insurance.

For every business type, the SBA tends to set size standards, which is based on average unemployment or annual receipts. It helps determine if the business is eligible to derive a loan guarantee in the ‘small business’ group.

Business principal code on tax returns

Principal code is essential for your business on tax returns. In case, your business offers you with different income sources, then choose the one providing optimum revenue.

For the majority of the business tax return types, both PBC and principal business description is to be offered. The description is to include a few words offering specifics on clients/customers & the category. The following are the two examples offered by the IRS: ‘real estate appraisals for lending institutions’ or ‘wholesale hardware sale to retailers’.

For single-owner LLCs & sole proprietorships, is present Schedule C, which requires:

- To enter on Line A, principal business description &

- To enter on Line B, the IRS business codes

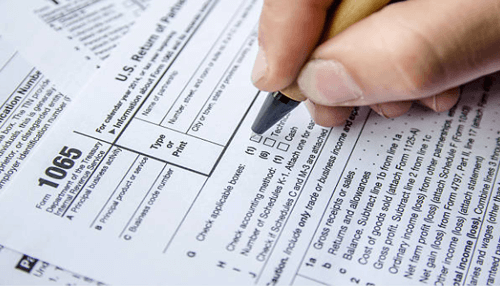

Form 1065 (Partnership Income Returns) for multi-member LLCs & Partnerships:

- Enter on Line A, principal business description

- Enter on Line B, principal service/product’s brief description

- Enter on Line C, the PBC

Doing some research will help you to know more about the principal business code.