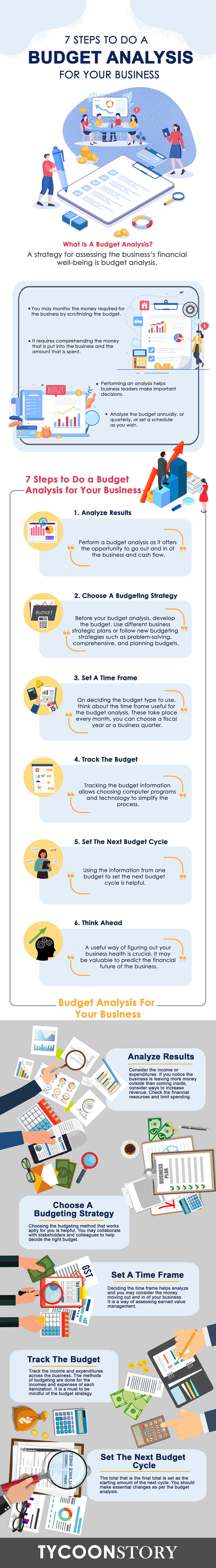

What is a budget analysis?

One strategy for assessing a business’s financial well-being is budget analysis. You may monitor the money required for the business by scrutinizing the budget. It requires comprehending the money that is put into the business and the amount that is spent. Performing an analysis helps business leaders make important decisions. Analyze the budget annually, or quarterly, or set a schedule as you wish. Learn the steps for Budget Analysis for Your Business. Explore strategies and techniques to improve financial planning and track business expenses effectively.

7 Steps to Do a Budget Analysis for Your Business

1. Analyze Results in Budget Analysis for Your Business

Evaluating the budget as per the given time frame is important. Consider the income or expenditures. If you notice the business is leaving more money outside than coming inside, consider ways to increase revenue. Check your financial resources and limit spending.

2. Choose a Budgeting Strategy for Budget Analysis for Your Business

Before your budget analysis, develop your budget. Use different business strategic plans or follow new budgeting strategies such as problem-solving, comprehensive, and planning budgets. Choosing a budgeting method that works best for you is helpful. You may collaborate with stakeholders and colleagues to help decide the right budget.

3. Set a Time Frame for Budget Analysis for Your Business

On deciding the budget type to use, think about the time frame useful for the budget analysis. These take place every month, you can choose a fiscal year or a business quarter. You may perform budget analysis even as quarterly or monthly or even set multiple periods. Deciding on a time frame helps with analysis and you may consider the money moving out and in of your business. It is a way of assessing earned value management.

4. Track the Budget for Budget Analysis for Your Business

A budgeting strategy is a determined decision and is best set within a time frame. Tracking the budget information allows choosing computer programs and technology to simplify the process. Track the income and expenditures across the business. The methods of budgeting are done for the incomes and expenses of each itemization. It is a must to be mindful of the budget strategy.

5. Set for the next budget cycle

Using the information from one budget to set the next budget cycle is helpful. It means the total that the final total is set as the starting amount for the next cycle. You need to make essential changes as per the budget analysis.

6. Think ahead

A useful way of figuring out your business health is crucial. It may be valuable to predict the financial future of the business. As you analyze the budget, you will get to understand the trends and your financial resource position and determine if you can predict the future budget as per the data available.

7. Explore solutions

Making sure of the budget analysis is to ensure productive results. The challenge in the budget is to explore multiple solutions. You may consider the business’s strategic plan, try brainstorming ways of budget improvement, and make financial information more useful. Also, follow the budget cycles to get the proper hint of your budget analysis performance.

Budgeting is not rocket science for anyone to follow. It may take some time to get the thread of it and requires one to be ready to make changes. Perform a budget analysis as it offers the opportunity to go out and in the business and cash flow. For any company, a budget analysis ensures the process is easier. It allows you to compare your budget, actuals, and forecast. One can easily build their business a financial plan without the need for spreadsheets.