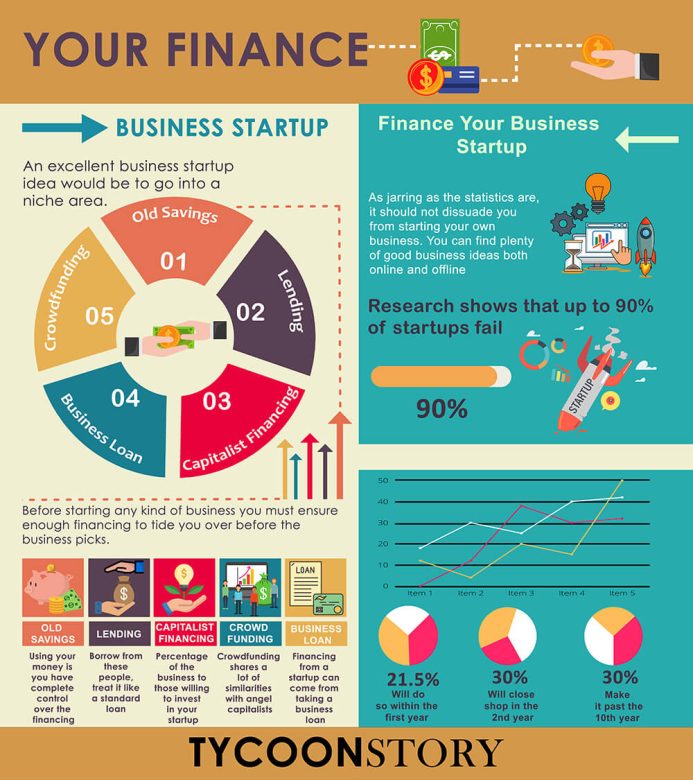

Starting a business of any kind comes with a host of challenges. You have to find a place within a very competitive market. Also, you must ensure enough financing to tide you over before the business picks, and you must think about how you will finance your business startup

Research shows that up to 90% of startups fail. 21.5% will do so within the first year. 30% will close shop in the 2nd year, and only 30% make it past the 10th year.

As jarring as the statistics are, it should not dissuade you from starting your own business. You can find plenty of good business ideas both online and offline.

An excellent business startup idea would be to go into a niche area. You could, for example, provide effective startup marketing company services. But your niche would be companies less than five years old. It saves you from competing for the business of more established companies.

Essential Considerations Before Financing Your Startup

But before you quit your day job, think about how you will finance your startup. Read on for some financing options.

1. Good old savings

When coming up with a business plan, make sure you have a section on financing. It would help if you had a pretty good idea of how much you would need to get the business up and running.

Depending on how much you need, you could always revert to your savings. But, of course, the assumption here is that you were diligent about saving.

The beauty of using your money is that you have complete control over the financing. But here is where it gets tricky. It would not be a good idea to sink all your cash into the business. In the event that it does not take off, you’ll be back to square zero with nothing.

A startup business comes with some unavoidable costs. First, you will need to register the business. Second, you must invest in some infrastructure. If you are opening a physical location, you must pay rent and equip the office.

For an online business, you will need someone to design a website. It also helps to consider some budget for marketing. Having a presence is critical if you want people to start knowing about your company.

We go back to the original point of being clear about your financing needs. If your savings can cover the cost and leave a little on the side, this may be the best option.

2. Borrow from family and friends

Some people may shy away from borrowing from family and friends. Failure to pay can result in the demise of close relationships.

Even if you borrow from these people, treat it like a standard loan. Draw up a payment schedule and stick to it.

Here is an idea worth exploring. How about offering them equity in the business. Have the option of buying your financiers out when the loan payment is complete.

In this way, they get to see how the business is doing. It also gives you a little negotiating room when things are not going well.

3. Try venture capitalist financing

Venture capitalist financing means that you open up the company to outsiders. You give a percentage of the business to those willing to invest in your startup. Get ready for a company valuation to determine its growth potential.

Demonstrating a competitive edge is critical, as you need to convince them to invest in an idea. Also, it helps to have good negotiating skills so that you do not give away too much of your company. Please seek the services of an expert to help navigate this part of the process.

Other than finance, venture capitalist financing exposes you to connections and resources. You can find some fantastic mentors who have a stake in seeing you succeed.

Do not confuse venture capitalist investors with angel investors. The latter may give you money without needing to see the growth potential. Sometimes it could be because of a personal relationship. They may not even want a piece of the business.

4. Appeal to the masses on Crowdfunding platforms

Crowdfunding shares a lot of similarities with angel capital. But, with the former, you must promise to deliver something to get access to their money. Angel investors will give you money upfront, as they are banking on your business idea.

Here is how crowdfunding works: First, pick a platform to use. You have many options available. So, take time to do thorough research on each. Next, put up a detailed description of your startup business idea. Show how the business will result in profit-making to sway the audience in your favor.

Also, talk about your funding needs and where the money will go. Your persuasion skills must be top-notch so that the audience buys into your ideas. If they like it, you will get pledges or donations.

And financing is not the only benefit. Talk to any digital marketing agency for startups. They will tell you that the marketing potential is great. You build awareness about the product or service right from the very beginning.

5. Take a business loan or use your credit card

Financing from a startup can come from taking a business loan. Shop around to determine the best options available. Pay attention to things like interest rates and repayment. A good credit score helps in negotiating the best rates.

But don’t fret if your credit score is not the best. Bad credit loans are an option. But the bank protects itself from loss of money due to non-payment with high-interest rates.

If you do not qualify for a bank loan, try your luck with microfinance companies. They are less demanding of the requirements for loan qualification and may offer alternative funding options, such as different types of inventory financing.

You also have the option of using your credit card to offset some of the business expenses. Users may also qualify for discounts and other rewards.

But you must be diligent about the payments. Your payment history is a significant deciding factor for your credit score rating. Be very careful about cash advances, as they can attract high interest rates.

Final thoughts

When looking for financing, start by determining how much money you need for the business. Use this as a guide when seeking financing, and only borrow what you need. We have looked at five ways to finance your business startup.

But there are many other avenues you can try. Grants, peer-to-peer lending, marketplace lending, and invoice financing are some of them.

Take the time to research all options so that you can decide what works best for you.

Good luck with your startup!